Purchasing A Home with Riba in Non-Muslim Lands: The Dar al-Harb Argument.

Attempting to navigate within the hegemonic riba monetary system and planning to escape it.

In the name of Allah, the Most Gracious, the Most Merciful. May peace and blessings be upon the Prophet Muhammad ﷺ.

In this blog post that I've written/compiled, I argue that Muslims who choose to purchase a home by entering into a mortgage contract, whether from a so-called "Islamic" bank or a conventional bank, are inadvertently causing harm on various levels. Although well-intentioned, using the minority Hanafi fiqh position of "Dar al-Harb" as advocated by Shaykh Amin Kholwadia (May Allah preserve him) and other Ulama to argue for the permissibility of taking and receiving interest and thus enabling the acquisition of a mortgage from a conventional bank, has the following negative consequences:

- Increases inflation

- Increases the cost of living

- Strengthens the global Zionist Central Banking Fiat System

- Extends war

- Opens the door to further questionable transactions

- Dissuades the Ummah from looking into real long-term solutions

The potential solution suggested by Shaykh Amin Kholwadia:

Some months ago Shaykh Amin Kholwadia engaged in a conversation with Shaykh Shadee Elmasry. One of the segments of their discussion focused on the concept that if Muslims adopt the theoretical paradigm (attributed to Imam Abū Ḥanīfah RA) stating that Muslims residing in non-Muslim lands are in "Dar al-Harb" (abode of war), they could potentially find justification for obtaining loans with interest (mortgages) in order to purchase a home.

I will present a summary of the rationale behind his stance first. The complete video segment is available below for you to watch yourself. In the end, I will elucidate why, despite the Shaykh's good intentions being clearly evident, his position presents problems on various levels.

NBF 235- Shaykh Amin Kholwadia Interview - Dr Shadee Elmasry

The section pertaining to this blog's subject matter spans from the 15:00 to the 35:00 minute mark.

Shaykh Amin begins by discussing his research in Islamic Finance. He was a member of a larger group of scholars and intellectuals responsible for writing a book about the current state and potential of Islamic finance. He was tasked with writing the first chapter of the book. As part of the project, he explains that they examined the existing conventional debt monetary system and compared it to the Islamic model, attempting to identify points of reconciliation. However, they ultimately realized that merging the two was not feasible, likening it to attempting to "fit a square into a round hole." The book was eventually utilized in various colleges in England to provide an introduction to Islamic Finance.

Shaykh Amin Kholwadia subsequently discusses how, simultaneously, they aimed for a slightly more innovative approach in seeking a solution. However, they chose not to attach an Islamic label to a Western instrument, as is done by some proponents of Islamic Finance / Banking with their purportedly Sharia-compliant mortgage offerings. The Shaykh expressed his disagreement with those who adopt that strategy. Instead, he aligns himself more closely with an alternative method in which they strive to grasp the differences between Dar al-Harb and Dar al-Islam. He considers this viewpoint to be a genius understanding by Imam Abū Ḥanīfah RA (born 699, Kūfah, Iraq— Muslim jurist and theologian whose systematization of Islamic legal doctrine was acknowledged as one of the four canonical schools of Islamic law madhhabs) and his students.

They argued that there is a distinction in the way Muslims live in Dar al-Harb compared to Dar al-Islam. Thus, the questions regarding Islamic transactions arise: Are they considered fard al-ayn (individual obligatory actions that every Muslim is personally responsible for performing), or are they primarily subject to the Wali or Hakim (judge or arbiter responsible for interpreting and applying Islamic law in legal matters and disputes.) and their governing decisions?

This is because the Wali possesses the authority to declare certain actions as wrong and demand repayment. In Europe or the USA for example, disputes about Islamic transactions cannot be brought before a judge, as they lack knowledge about Islamic transactions. This puts Muslims in a compromising position, as they'll likely have to abide by the local laws, which might contradict Islamic jurisprudence.

Hence, Shaykh Amin Kholwadia argues, the need to reestablish the notion that these two systems are distinctly different. While some moral theories may overlap and be compatible in certain aspects, the regulation of specific transactions remains unclear. The argument is for the necessity of a new system of Islamic finance, as practiced in Dar al-Harb. This is the objective they aim to achieve at their institute, Darul Qasim College.

Shaykh Amin clarifies that individuals frequently err in assuming that the classification of land as "Dar al-Harb" implies an ongoing war or battle. Those unfamiliar with fiqh terminology tend to make this novice error, he explains. According to Shaykh Amin, Dar al-Harb refers to a land where Islamic law cannot be willingly applied, where the integrity of Islamic law is compromised, and where an alternate legal system based on a different worldview holds supremacy. This aligns with the Hanafi definition, Shaykh Amin says and has no association with actual warfare.

Shaykh Shadee Elmasry subsequently describes the various contract types offered by Islamic Finance Companies/ Banks, which effectively facilitate riba through a combination of contracts. To many Muslims, including Shaykh Amin, practices of this nature appear to resemble financial maneuvers, which may adhere to the letter of Islamic law but fail to align with its spirit. Shaykh Amin Kholwadia expresses his concern about the monthly repayment rates that Islamic Banks offer for their mortgages. He finds them exorbitant. They are more expensive than conventional mortgages, which is a common complaint among a lot of Muslims.

That's why Shaykh Amin is attempting to revive the Dar al-Harb argument. According to him, it's a more coherent and consistent theory than what Islamic Finance / Banks are doing now with their contract offerings. To support the Dar al-Harb argument, he provides the example of Qisas (the principle of proportional retribution for crimes, allowing victims or their families to seek equivalent punishment or compensation for intentional harm).

‘‘Can we independently carry out Qisas in the USA or Europe? No, because it's within the government's prerogative. If they choose capital punishment and opt to execute someone, they possess the constitutional prerogative to do so. As Muslims residing in these non-Muslim lands, we can't demand that the Qur'an mandates us to carry out Qisas. In this scenario, all scholars would concur that Qisas is not obligatory for Muslims in this country; no scholar would insist on taking the individual to Dar al-Islam for execution. Every scholar is compelled to acknowledge that in the matter of implementing Qisas, Muslims are pardoned and exempt from that ruling.’’ This serves as an example where Dar al-Kufr creates a distinction in the hukm/ruling, as per Shaykh Amin's perspective.

He desires to apply this rationale to other Ahkam,(legal rulings determining the religious permissibility or obligations of various actions based on Islamic sources and principles). He articulates:

"Does it apply to Zabiha? No, because we don't require a government prerogative for Zabiha (referring to the method of slaughtering animals according to Islamic law). Does it apply to Nikkah? No, because we don't need government intervention for that (marriage contract). Will it apply to divorce? Perhaps in some cases, but not in others. For instance, what should we do about those aspects of divorce where implementing Islamic laws isn't feasible? We must find creative solutions consistent with the theory of Qisas. We will adhere to the law to the best of our ability, but we are still exploring this because it presents a significant challenge for Muslim divorced women who are left without much recourse when Islamic Sharia law is implemented. You could call it a personal trial or test for them, but ultimately, Muslims are suffering, and they often resist the idea of implementing Islamic divorce laws.

So, how can we address such problems? We must address the issue and assist Muslims; it's not about changing Islamic law, but rather about aiding women in dire situations. What can we do for her? Some also ask, what about the divorced woman's brothers, sisters, and family? What if she has no family? What if her relatives are not Muslim? Why would they assist her? These are questions we are examining. I'm not suggesting for a moment that we alter Islamic law; I'm not advocating for that. I'm saying we need to find a coherent theory that benefits Muslims who are sometimes in compromised situations. This is another area where you might discover that Islamic law cannot be implemented fully, and this can also be extended to other rules and ahkam in Islam, such as riba/interest."

Shaykh Amin proceeds to pose the question, "Is riba something from which Muslims can be exempt in non-Muslim lands?" According to him, the distinction between the theory of riba and the hukm of riba (Hukm is an arabic term that translates to "ruling" or "judgment" . In Islamic jurisprudence it refers to the legal ruling or verdict issued by a qualified Islamic scholar or jurist regarding a specific issue or matter) is significant. While he adheres to the teaching that it is wrong to profit from lending money and acknowledges it as "atrocious" and "almost inhuman," he also raises the question, "To what extent and in what manner can we practice Islam in Dar al-Harb?" Some Usuliyuun (Islamic jurists) suggest that living in Dar al-Harb indefinitely is not permitted, as one should practice Islam comprehensively. However, the dilemma arises: What should be the course of action for the millions of Muslims residing in non-Muslim lands? Even if all Muslims were to resettle in Muslim lands, there would still be challenges in achieving full Islamic practice there. It's a catch-22 situation (moral dilemma).

Shaykh Amin Kholwadia urges the Ulama not to "force the issue" and to consider the repercussions of doing so. He expresses frustration over the lack of a coherent solution within the Muslim community, stating, "As Ulama, we are challenged." He then goes on to elaborate on the Dar al-Harb thesis, which he views as a potential solution. According to his interpretation of Imam Abū Ḥanīfa RA's teachings, he points out "There is no riba in Dar al-Harb. Therefore, he's not legalizing riba; rather, he's clarifying that it's not riba in the first place. He's not categorizing it as halal or haram; he's stating that there's no specific ruling on it — the transaction is not viewed as a transaction in Dar al-Islam or Dar al-Kufr."

Due to the legal theory of Dar al-Harb by Imam Abū Ḥanīfa RA, some contemporary Ulama used his view to justify Muslims in non-muslim lands being able to take and receive interest. The Ulama mentioned by Shaykh Amin Kholwadia includes "Shaykh Yusuf Al-Qaradawi, Shaykh Ali Gomaa, two or three Ulama from the subcontinent, and most of the Ulama in Turkey."

Obtaining a mortgage raises the cost of living.

I'll begin by asking Allah to continue to bless & preserve Shaykh Amin Kholwadia & Darul Qasim Institute. I concur with him that the contracts offered by Islamic Finance Companies, which claim to provide riba-free mortgages, indeed conceal riba through a combination of contracts (Contractum trinius).

If anyone is interested in understanding precisely how this is accomplished, I recommend listening to Tarek El Diwany here:

Tarek El Diwany also has a great documentary detailing the history of how and why usury/riba became normalized by humanity. It is called "Why Are We All In Debt?" :

Shaykh Haitham Al Haddad also explains how Islamic finance contracts are linked to usury/riba :

Although this is true, the supposed solution provided by Shaykh Amin Kholwadia & other Ulama who subscribe to the Dar al-Harb narrative, to justify Muslims in non-Muslim lands getting conventional mortgages (which admittedly are cheaper than ‘‘Islamic’’ finance ones), is also harmful to the Muslim community on various levels.

One reason why the Dar al-Harb narrative is inconsistent and harms Muslims is due to the lack of acknowledgement of the negative externalities with global corporate financial structures. Whether a person is Muslim or not, when they take out a loan from a bank to purchase a house, the bank does not provide them with money that is already in circulation, whether from its own funds or its depositors' money. Instead, the bank creates a fresh sum of $300,000 or £500,000, or whatever amount the borrower needs to buy their home. As they leave the bank, the money supply in the economy increases because of their loan request to finance the home.

The reason why that's problematic is that increasing the money supply reduces the purchasing power of the money already in circulation in the economy, leading to higher prices for goods and services like fuel, food, and rent. In other words, life becomes more expensive for everyone. Therefore, a person who borrows money from banks, whether conventional or from so-called "Islamic" finance/banks, is contributing to inflation.

This is how fiat paper money, which we are forced to use due to legal tender laws, operates. The national currencies we use today, such as US dollars, Great British Pounds, Euros, Chinese Yen, Pakistani Rupees, Turkish Lira, and others, are essentially created through government credit/debt and the credit of banks backed by the Central Bank. These fiat currencies are inherently linked to riba/interest.

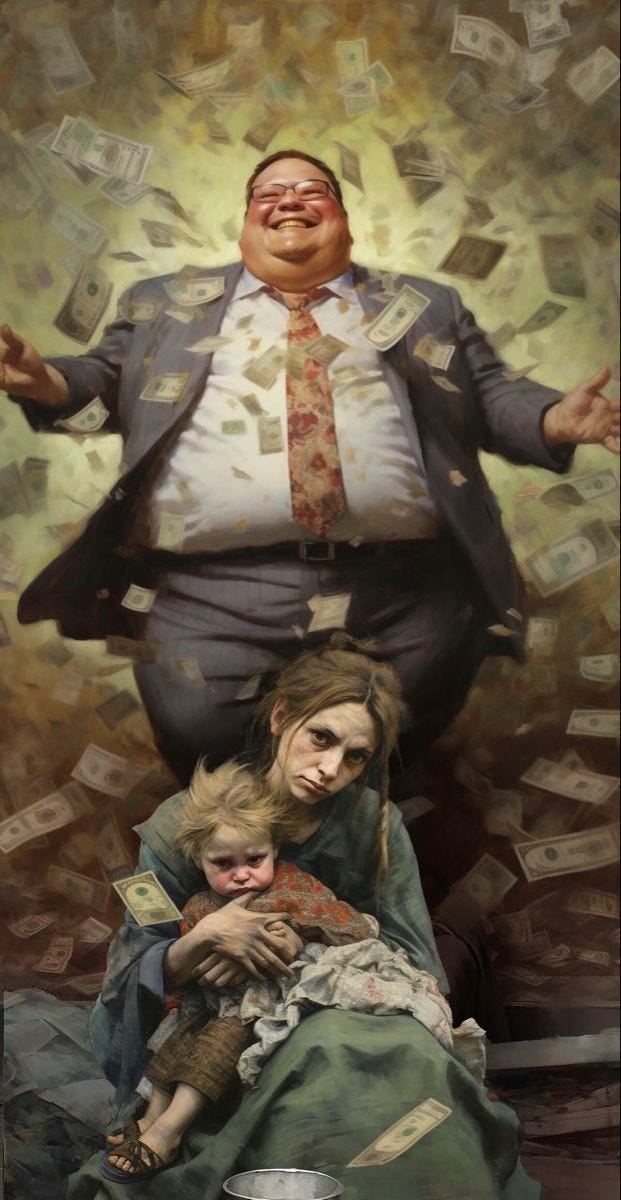

The only people who benefit from this horrible monetary system are the privileged few, at the expense of the majority of humanity. These privileged few are the institutions granted the authority to issue fiat through loans backed by Central Banks. Corporations also benefit due to the "Cantillon Effect," which refers to the uneven distribution of benefits resulting from changes in the money supply.

It suggests that those closest to the source of new money (colloquially referred to as "those closest to the money printer") tend to benefit the most, as they have early access to the increased money supply before more inflation hits. They use the new money created out of nothing to buy assets that appreciate over time. The sick ironic part is that these ‘‘assets’’ (like homes, for example) appreciating over time are a result of the very credit bubbles created in the market by riba-based loans (mortgages). In other words, rising house prices each year indicate that money is losing its purchasing power further.

Professor Saifedean Ammous, the author of the book "The Fiat Standard: The Debt Slavery Alternative to Human Civilization," which examines the various ways the central bank’s riba system harms humanity, expresses the following viewpoint regarding the present monetary system:

"Borrowing money imposes a tax on society, while offering a subsidy to the borrower. In the current fiat-based monetary system, a Muslim who chooses not to engage in borrowing money due to religious convictions against usury/interest effectively subsidizes everyone else who does borrow money. Essentially, they are paying to support others through this subsidy."

It's evident from this reality that if Muslims continue to borrow money to purchase homes, whether they do so through "Islamic Finance" contracts claiming to be riba/interest-free or by subscribing to the Dar al-Harb argument proposed by Shaykh Amin Kholwadia & others (which justifies obtaining mortgages from conventional banks), they are contributing to inflation via riba credit creation.

The consequences of this disproportionately affect the Muslim community, a lot of whom choose not to borrow money from banks due to religious reasons. This inflation, resulting from an increased money supply, not only erodes the savings of individuals compelled to hold fiat currencies by nation-states but also steals their time and energy, as people find themselves needing to work harder and longer to make ends meet due to the cost of living.

Offering justification for engaging in decades-long debt contracts with these malevolent institutions, which have inflicted harm upon humanity, only serves to further empower the riba demon. Should we genuinely support this monetary system? Asserting that it is Islamically permissible to obtain conventional mortgages due to our residence in Darul Harb hinders the drive to explore authentic alternatives.

What's the alternative if obtaining conventional mortgages or mortgages via "Islamic Finance" both contribute to the riba demon?

What about renting?

Some suggest that it's better to rent until you've saved enough to buy a home with cash. However, as mentioned earlier, saving with fiat currencies is extremely challenging due to their declining purchasing power caused by inflation resulting from the increased money supply, some of which comes from interest-bearing loans.

I empathize with the renting perspective because, at least with renting, you're not contributing to the increase of the money supply and are only dealing with the existing fiat currency in circulation. On the other hand, if you, as a Muslim, opt for "Islamic finance/banking" or a conventional mortgage, your loan creates a demand for more fiat currency to be injected into the economy.

However, individuals advocating for renting should be aware that, despite not obtaining usurious riba loans from banks, the fact that they utilize fiat currencies for renting and purchasing other goods and services implies that they are still affected by the dust of riba. This underscores the insidious nature of the debt/riba system; even if you explicitly avoid interest-based loans, you are still entangled with riba due to the fiat currencies mandated by nation-states, which are created from debt/riba.

"In the fiat system, riba is inherently baked in at the protocol level"

~ Saifedean Ammous.

This was prophesied by The Prophet Muhammad ﷺ when he stated:

"A time will come upon people during which they will consume usury." When asked if this applied to everyone, he replied, "Whoever does not consume it will still be affected by its dust."

Source: Musnad Aḥmad 10191

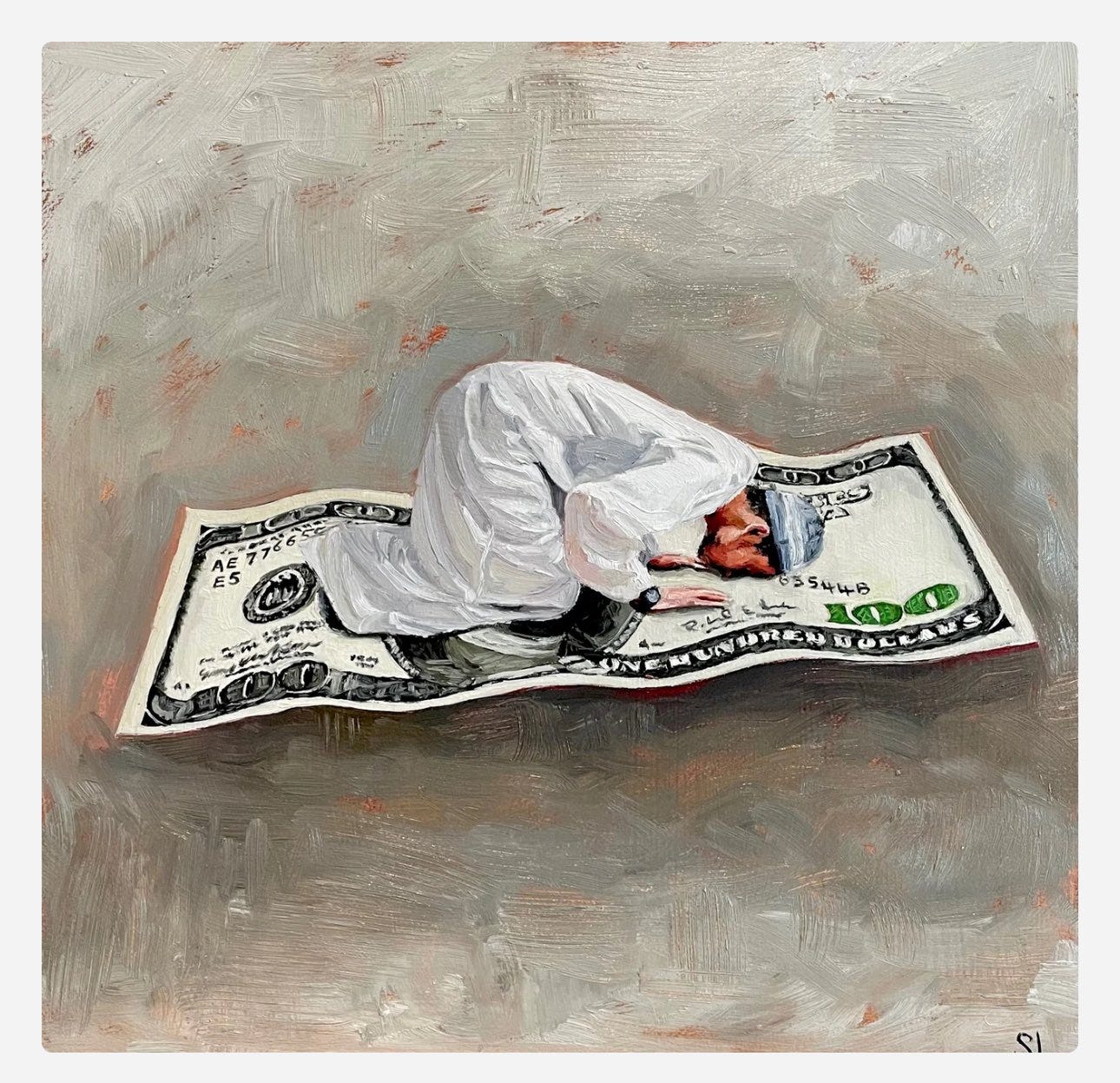

The global fiat monetary system imposed by central banks forces everyone to varying degrees to be involved in riba (interest). It offers no exemption to Muslims or anyone else. Within this monetary framework, we resemble a person stranded on a remote, uninhabited island where the sole sustenance available is pork.

Consuming pork is considered haram (forbidden) in Islam, but scholars concur that if faced with a life-threatening situation, one is permitted to eat a small amount of it to survive, albeit reluctantly and without indulgence. If such an individual were to excessively gorge on pork, rationalizing it as a necessity for survival, most Islamic scholars would criticize the excessive consumption.

Drawing parallels with riba and mortgage loans, it becomes evident that we, as Muslims, should strive to limit our involvement with fiat/riba to the bare minimum. Otherwise, we risk partaking in something displeasing to God and may be held accountable. May Allah forgive our shortcomings and weaknesses.

It could perhaps be argued that Muslims who take out fiat loans from banks to finance a home purchase are overconsuming pork, while those Muslims who choose to rent instead are only taking small bites of pork to stay afloat within the hegemonic riba monetary system.

Studying this fiat monetary system truly helps a Muslim to appreciate the commands from Allah/God to abstain from riba. It has never been clearer in history why and how riba is such a destructive and evil force in the world. A society permitting riba/interest and normalizing it will ultimately lead to the creation of circumstances where some individuals can enslave others through debt. It's no wonder that the Ulama only reluctantly allowed paper currency (fiat) due to 'Umum Al Balwa (ubiquitousness of an affliction).

Those who control the global central banks’ fiat monetary system are pro-Zionism.

Another reason why the Darul Harb argument, which justifies Muslims obtaining mortgages, is detrimental, is because it strengthens the monetary system that Zionism has and continues to benefit from. This global riba system has been particularly harmful to the Palestinian people.

‘‘The Bank of England, followed by the US Federal Reserve Bank, successfully controlled the world, both militarily and economically. Their economic dominance enabled military control, with their motivation being to subject the world to a central banking system benefiting them through inflation. This global central banking system played a fundamental role in financing the Zionist movement from its inception. The Rothschild family, a prominent banking family, played a key role in establishing the global central banking system and contributed significantly to funding the Zionist project. The central banking system, reliant on government-backed currencies, has profound ties to the Zionist movement. As Palestinians, we have borne the cost of this system for the past century.’’

~ Saifedean Ammous.

The Federal Reserve, colloquially known as "The Fed," serves as the central point of the global debt-based monetary system that we are all forced to use. It possesses the authority to annul transactions and seize balances from other central banks worldwide. The Fed unilaterally governs the SWIFT payments network, influencing nations' participation and trade settlements. The underlying layer of this fiat network utilizes a native token of debt denominated in U.S. dollars.

"Shaykh Taqi Usmani maintains that outside of Dar al-Islam, riba (interest on loans) allowed the Rothschild family to "acquired financial mastery over the whole of Europe and the Rockfeller over the whole of America"

Muhammad Taqi Usmani (December 1999). The Historic Judgment on Interest Delivered in the Supreme Court of Pakistan, Para 173.

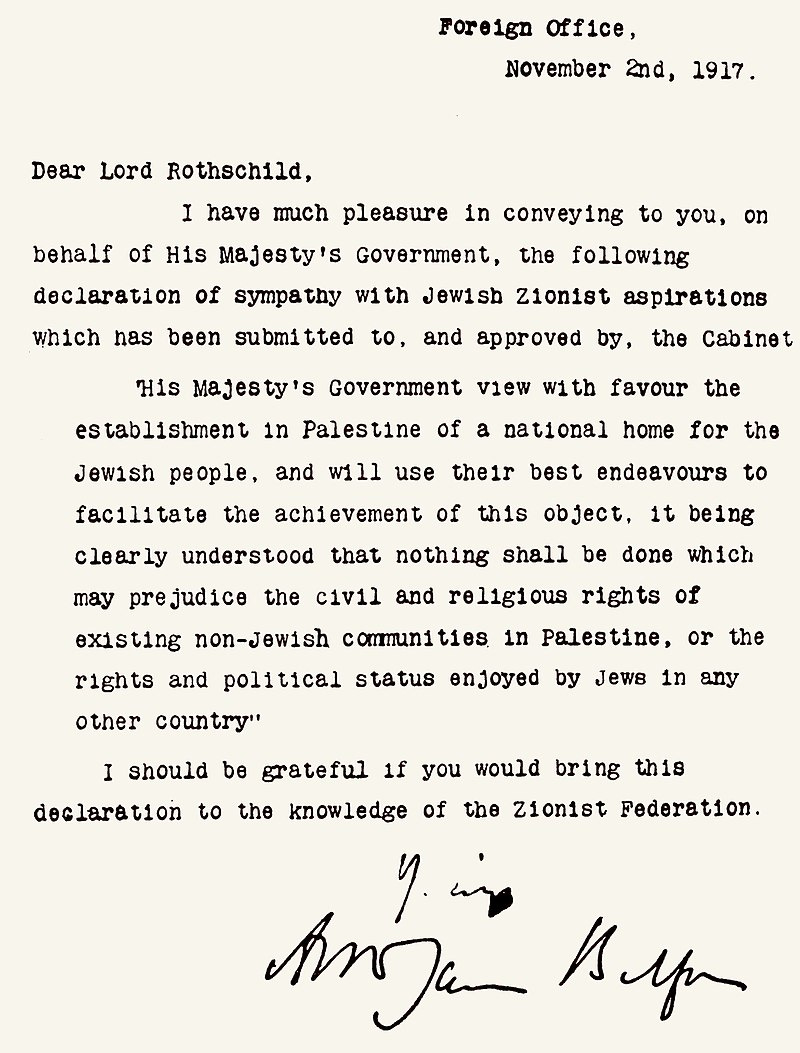

Eustace Mullins, in "Secrets of the Federal Reserve," attributes the Fed's establishment to the "Rothschild-controlled Bank of England." The Rothschild banking family played a crucial role in the formation of Israel. The Balfour Declaration, issued by the British government on November 2, 1917, expressed support for a "national home for the Jewish people" in Palestine, then part of the Ottoman Empire. Addressed to Baron Lionel Walter Rothschild, a prominent British Jewish leader and member of the Rothschild banking family.

The global central banks fiat network comprises around 190 central bank members of the International Monetary Fund (IMF), as well as tens of thousands of private banks, with many physical branches. At the time of writing, the fiat network has achieved almost universal adoption, and almost everyone on earth is either dealing with a fiat node or handling fiat paper notes issued by these nodes.

Joining the fiat network is not voluntary; it can be best likened to mandatory malware. With the exception of a few primitive and isolated tribes yet to have fiat enforced upon them, every human on earth is assigned to a regional node where they must pay their taxes in their local “fiatcoin.” Failure to pay with the local fiatcoin can result in physical arrest, imprisonment, and even murder.

The global fiat network is based on a layered settlement system for payment clearance. Individual banks handle transfers between their clients on their own balance sheets. National central banks oversee clearance and settlement between banks in their jurisdictions. Central banks, and a few hundred international correspondence banks, oversee clearance across international borders on the SWIFT payments network. The fiat network utilizes a highly efficient centralized ledger technology with only one full node required to validate and decide the full record of transactions and balances. That entity is the United States Federal Reserve, under the influence and supervision of the United States government.

While fiat enthusiasts portray the network as having a variety of tokens, each belonging to a different country or region, the reality is that every currency but the U.S. dollar is merely a second-layer token, a derivative of the dollar. The value of non-U.S. fiat money depends on its backing in the U.S. dollar and can best be approximated as the value of the dollar with a discount equivalent to the country risk. For a variety of historical, monetary, fiscal, and geopolitical reasons, these tokens have not appreciated significantly against the U.S. dollar over the long term. For all practical intents and purposes, national central banks managing their currencies can either maintain their exchange rates with the dollar or devalue them faster than the dollar.

~ Saifedean Ammous.

The U.S. Dollar is the primary fiat currency globally, with other national currencies from around the world subordinate and tied to it:

1. United States Dollar (USD)

2. Euro (EUR)

3. Japanese Yen (JPY)

4. British Pound Sterling (GBP)

5. Swiss Franc (CHF)

6. Canadian Dollar (CAD)

7. Australian Dollar (AUD)

8. Chinese Yuan (CNY)

9. Swedish Krona (SEK)

10. New Zealand Dollar (NZD)

11. Turkish Lira (TRY)

12. Pakistani Rupee (PKR)

13. Saudi Riyal (SAR)

Etc...

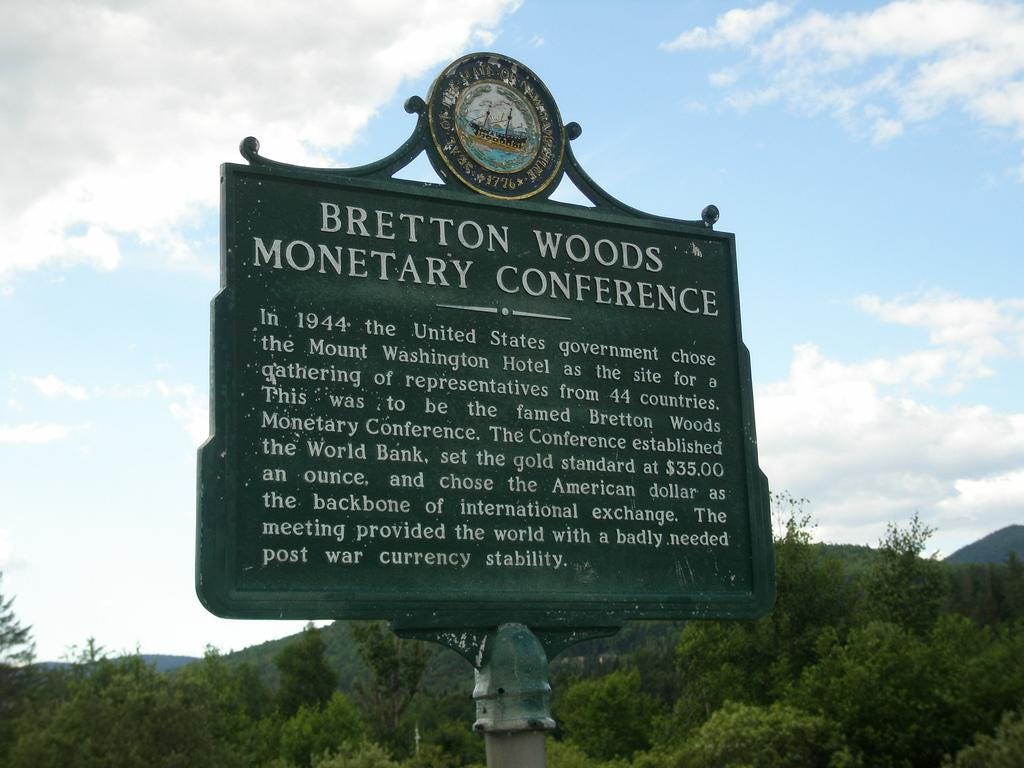

This easily created riba fiat money prolongs the duration of wars:

Ever since World War One began, the world has been embroiled in an unending cycle of conflict that continues to this day. If you examine the world's current conflicts, most of them can be linked back to World War One. This is because when the Pandora's box of government control over money was opened, there was no longer a real restraint on war, except for complete defeat, utter destruction, and the loss of countless lives.

War had to be total. Before that, under the gold standard, kings would send professional armies to battle each other on battlefields. As soon as it became clear that one side was gaining an advantage, the fighting would cease, and the kings would then negotiate new terms because it was extremely expensive to maintain a professional army, and funds were running low. So the wisest course of action was to halt the fighting whenever possible. Wars would occur, you know, with countries battling each other on the battlefield.

However, in the cities, life continued as usual, and people from both countries would engage in trade. Life carried on while the war raged on as an independent aspect of politics. It was like saying, "All right, we have an issue regarding this piece of land. Let's settle it through battle on the battlefield. We won't fight in civilian areas; we'll take it outside. We'll have the battle with professional armies." And, in fact, sometimes the complex situation involved armies lining up. They would have a small contingent from each army engage in battle, and as soon as one side gained an advantage, they'd declare the winner and move on.

Governments were much more cautious about their war policy when they couldn't print money. However, this has changed with fiat currency, giving rise to a new class I like to call "chicken hawks." These are individuals who work in offices, such as the entire foreign policy establishment in Washington, D.C. They've never experienced war firsthand, and their children won't either. They won't bear the financial burden of war, nor will they suffer the consequences of war in their own homes.

They make decisions based on flawed teachings from fiat-financed universities regarding politics and geopolitics, leading to decisions like invading countries and sending more troops, all enabled by the endless money printer. That's why, you know, in the days of the gold standard, if you were a warrior, you actually went and joined the war.

The ones pontificating about war were those with firsthand experience, who sent their own children to battle and funded the conflict with their own resources. Now, we have many individuals in Washington, D.C., and similar places worldwide who have never fought and will never face the consequences, yet they manipulate global currency values to send others' children into senseless conflicts based on misguided political ideologies they learned in fiat financed universities.

~ Saifedean Ammous.

More questionable transactions in Dar al-Harb.

Assuming we concede to the Dar al-Harb argument, and that's presuming Imam Abū Ḥanīfah’s (RA) position is being accurately presented, will the other ahkam/rulings regarding what actions can be undertaken by Muslims in Dar al-Harb also receive approval?

Charging and taking interest are not the only transactions allowed in Dar al-Harb. Selling alcohol and pigs is also included. Does this imply that Shaykh Amin Kholwadia and the other Ulama who adhere to the Dar ul Harb narrative will approve of Muslims in non-Muslim lands today opening alcohol stores and butcher shops that sell pig meat? If not, why not? If only dealing in riba is permitted so that Muslims can obtain cheaper mortgage rates in Dar al-Harb, but not selling alcohol and pigs, doesn't this inconsistency contrast with what Imam Abū Ḥanīfah RA allowed in Dar al-Harb? Is this not a rather slippery slope?

According to Shaykh Muhammad Said Ramadan al-Bouti, Imam Abū Ḥanīfah’s (RA) stance is being misinterpreted; moreover, not all Hanafis concur that Muslims are permitted to partake in otherwise impermissible transactions in Dar al-Harb:

"The occasional fatwa that comes to us from Europe, wherein one asks, 'I desire to purchase an apartment but lack the necessary funds, my current dwelling is small, and I wish to expand. However, I can only acquire a loan with interest. Could you advise us on the permissibility, according to the Hanafi school of thought, of taking a loan with interest?'

I seek refuge in Allah, I seek refuge in Allah. What is the origin of this notion and from whence does it emanate? Observe, my dear brethren, how an issue rooted in Islamic jurisprudence is amplified and distorted to introduce an unfounded gap within Islamic law. In the view of Hanafi scholars, if the Muslims are engaged in warfare against a hostile state, they are categorized as 'Harbiyeen'.

This classification does not apply outside a state of war, unlike our circumstance in Europe. Upon the outbreak of hostilities between us and them, each instance of 'Harbiyeen' seizing our assets / property deems them entitled to such possessions. Conversely, our acquisition of their wealth / property in similar fashion is considered legitimate. Two prerequisites must be met for the label 'Harbiyeen' to be applicable.

Firstly, there must exist a genuine state of war between the parties, and secondly, you take , not give interest. I beseech you to scrutinize the teachings of Imam Abu Hanifa (may Allah have mercy upon him) and contrast them with the assertions made by these individuals. Does the opinion of Abu Hanifa (may Allah have mercy upon him) now render riba (interest) permissible in our interactions with Europe and America?

May Allah fight those who oppress the Muslim community. Did Abu Hanifa (may Allah have mercy upon him) genuinely advocate such a stance? Does a genuine state of war exist between you and a European nation? If so, the position articulated by Abu Hanifa (may Allah have mercy upon him) concerning riba (interest) reinforces the validity of these stipulations. Yet, the current reality diverges markedly, for it is the Muslim community that finds itself burdened with interest-laden loans."

Mufti Saif al-'Asri is also against Dar al-Harb fatwas:

Question: Is it permissible to conduct interest (riba) based transactions in Western countries?

Mufti Saif al-'Asri: This question is very important, especially if the intention of this Muslim, who lives in a Muslim country, is to introduce them to Islam and its way of life, and to be an exemplary person that people imitate. So, if when he comes to a non-Muslim country, he says: "There's an opinion that the Hanafis have which considers it permissible to conduct otherwise impermissible transactions in non-Muslim lands.

So, it's permissible for me to sell pigs to them and it's permissible for me to engage in interest (riba) based transactions with them. Some Hanafis make the condition that he is the one receiving the interest and not giving it, meaning he's the one receiving the benefits (of the interest-based transaction) and he's not benefiting the one he's conducting a transaction with, and so forth.

This is an opinion, an opinion that exists. We can't wipe away this jurisprudential opinion. And it has its evidence. However, the vast majority of scholars, and it's even an opinion within the Hanafi school itself, are of the view that it is haram for a Muslim to conduct an impermissible transaction with a non-Muslim. It is not permissible for him (a Muslim) to conduct an interest-based transaction with him (Non-Muslim), nor is it permissible to sell or buy alcohol from him, nor is it permissible to sell him pork, and so on and so forth.

None of that is permissible. And this opinion is the opinion of the vast majority of scholars. It's the opinion that allows you as a Muslim to be proud of your religion in front of others. It allows you to proudly showcase the distinguishing features of Islam and take honor in the religion that you ascribe to.

On the other hand, if you're going to take legal dispensations and conduct transactions based on these things, how are you going to be a caller to this religion? Through your character? The way you speak? Your actions? How? How are people going to look at you? If they say: "Islam prohibits pork; however, masha'Allah, this Muslim at the store sells pork." I mean, what will make you different from other people? A Muslim must not conduct impermissible transactions, whether it's interest or other than it in Western countries.

Mufti Taqi Usmani on riba in Dar al-Harb:

Question 1: Is it permissible to obtain an interest-based loan for a home in America on the basis that America is Dar-ul-Harb? I understand that a Mufti from Deoband gave a fatwa saying it is permissible for Muslims in India to give and receive loans on interest since India is Dar-ul-Harb. If it is permissible, on what basis and are there any restrictions? This is a very big issue in the US since Muslims cannot purchase homes on interest, there are no interest-free banks, and rentals for flats are the same as paying mortgages.

Answer 1: Although some past jurists held the view that riba transactions with non-Muslims in Dar-ul-Harb are not impermissible, this minority perspective never gained favor with the majority of Muslim jurists worldwide. Their main argument is that the prohibitions imposed by the Holy Quran are of universal nature and do not vary from one country to another. For example, drinking or selling wine to non-Muslims in a non-Muslim country is as prohibited as it is in a Muslim country. Likewise, adultery and prostitution in a non-Muslim country are as impermissible as they are in a Muslim country. The case of riba is not different in this regard. Its prohibition remains operative worldwide; therefore, it is not permissible for a Muslim to transact on the basis of riba even when in a non-Muslim country, which is termed as Dar-ul-Harb. Consequently, it is not permissible for Muslims living in Western countries to enter into loan transactions based on interest, even for the purpose of acquiring a home. This is why Muslims in these countries are endeavoring to establish their own institutions for house financing. Several such institutions have been established in North America and the UK.

Question 2: Please clarify for me the exact Hanafi position on the taking of interest from the kuffar in Dar al-Harb. Is it permissible to take advantage of the interest offered freely by these people or not? What do the ulema say about the passages in Fathul Qadeer and Shami which appear to state that the Hanafi position (at least that of tarfain) is that it is permissible to take advantage of this when the benefit is for the Muslim? If it is not permissible, then please explain these texts and the hadith “la riba bain al harbi wal muslim” on which they are based.

If someone takes interest from the kuffar on this ruling, is he committing a haram or makrooh act? If it is permissible, then can this money be used to fund the activities of Muslims in these countries for the sake of deen such as setting up Muslim schools, etc.? I do not require a fatwa but merely the opinion of the ulema such as Mufti Taqi Sahib, as I realize that sometimes their opinions may differ from the legal fatwa which is required for the people.

Answer 2: The transaction of interest with non-Muslims in Darul Harb was allowed by Imam Abu Hanifa subject to certain conditions. However, the majority of the Fuqaha, including the Hanafi jurists, have not accepted it, and the fatwa has always been given on its impermissibility. A comprehensive discussion on this subject can be found in the detailed treatise written by Maulana Zafar Ahmad Usmani, titled "Kashf-al-Dujah," published in the 3rd volume of Imdad-ul-Fatawa. You may consult it for further details.

Nevertheless, even following the majority view on the impermissibility of Riba in Darul Harb, the interest received from Darul Harb can be used for charitable purposes, such as helping needy persons entitled to receive Zakat. However, under no circumstances can the amount of interest be used for one's own benefit.

Shaykh Faraz Rabbani on riba in Dar al-Harb:

Question: Could you please throw more light upon the statement in Sh. Nuh Keller’s ‘Reliance of the Traveller’, whereby it is stated that it was the position of Imam Abu Hanifa that it is permissible to receive interest from non-Muslims by Muslims living in Dar-ul-Harb. If that is the case can we Muslims accept interest from the banks in the UK etc?

Answer:

بسم الله الرحمن الرحيم

Walaikum assalam,

1. It is not permitted to take riba (such as bank interest) in the West in the Hanafi school, as the reality of the West is fundamentally different from the reality the scholars talked about in these types of rulings.

This is the position of the top Sunni scholars across the Muslim world. Those who may say otherwise are unquestionably mistaken, and are unwittingly getting Muslims into a lot of material and spiritual trouble.

2. Sh. Nuh Keller translated a strong refutation of those who claim otherwise by a top Syrian Hanafi scholar of the 20th Century, Shaykh Muhammad Hamid. You can find it in the Reliance.

These are just a small selection of answers given by scholars refuting the notion of the permissibility of Muslims taking and receiving riba/interest in Dar al-Harb. If you want to read more, you can do so on this website. Many of these answers refuting Darul Harb Fatwas are from Hanafis themselves.

Heres is the Maliki view:

What is the solution to the global riba monetary system?

What is the remedy? How can individuals, including Muslims or anyone opposed to endorsing the existing central bank's fiat monetary system, break free from the interest-based network? How can they discontinue the use of ribawi fiat currencies? In the long run, how can humanity transition to an economic system founded on a currency, whether it be gold or something similar or even with better attributes than gold that cannot be created arbitrarily? This transition aims to diminish the influence of central banks and governments globally that align with the Zionist movement.

Some Muslims suggest that the ultimate solution is to return to the gold standard. They acknowledge that there is no explicit command in the Qur'an and Hadiths that mandates the use of gold, but they reason that gold was used at the time of the Prophet Muhammad ﷺ. Additionally, they point out that the nisab (threshold or minimum amount of wealth or assets that a Muslim must possess before they are obligated to pay a specific form of almsgiving known as zakat) is calculated in gold and silver, making it a part of Islamic muamalat (Islamic financial transactions that adhere to Sharia law, prohibiting interest & emphasizing ethical conduct).

Furthermore, they argue that gold cannot be created out of interest-bearing loans, as paper fiat national currencies are made, making gold a form of "sound money." In other words, it is challenging to create or inflate.

To help people understand what constitutes good money, both Muslims and non-Muslims who advocate for a return to the gold standard encourage individuals to ask themselves the following questions:

What is money?

Why was gold chosen by the free market as money?

Why has gold endured for over 5000 years?

What qualities of gold led to its selection?

They argue that by pondering and researching these questions, one would likely conclude that the majority of humanity chose gold as money because of the following inherent characteristics:

• Divisibility: Ability to break down a sum of money into smaller units or denominations. Money should be divisible so that it can be easily exchanged, making transactions more convenient.

• Durability: Money must be durable to ensure it remains in circulation and retains its value; it should not be easily damaged.

• Recognisability: Refers to the ease with which a form of money can be identified and distinguished from counterfeits. It encompasses design elements, security features, and overall appearance that make it easy for people, including both the general public and experts, to recognize genuine currency and distinguish it from fake or altered versions.

• Portability: The ease with which a form of money can be carried and used for transactions is known as portability. Portable money is typically lightweight, convenient to carry, and widely accepted, making it suitable for everyday transactions and purchases. Portability ensures that money can be easily transported and used for various financial transactions, regardless of location or circumstances.

• Scarcity: Its rarity compared to global demand makes it a sought-after asset, and its limited supply ensures its enduring worth.

Some advocates of gold, who champion it as a solution, often appeal to the concept of '‘intrinsic value.'‘ In other words, when you ask such individuals why gold is valuable, they will respond with '‘because gold has intrinsic value.'‘ When further pressed to explain what intrinsic value actually means, they will point out that gold is not only used as money but also serves other purposes, such as in shiny jewelry and electronic parts.

This statement represents a partial truth. Gold does derive some of its value from its utility in non-monetary applications, but that constitutes only a small percentage. The majority of gold's value primarily arises from its esteemed monetary characteristics:

Divisibility

Durability

Recognisability

Portability

Scarcity

Could Bitcoin Be A Solution?

Gold does have non-monetary industrial use, but only about 10% of its demand is industrial. The other 90% is based on bullion and jewelry demand, for which buyers view gold as a store of wealth, or a display of beauty and wealth, because it happens to have very good properties for it in the sense that it looks nice, doesn’t rust, is very rare, holds a lot of value in a small space, is divisible, lasts forever, and so forth. If gold’s demand for jewelry, coinage, and bars were to ever decrease substantially and structurally, leaving its practical industrial usage as its primary demand, the existing supply/demand balance would be thrown out and this would likely result in a much lower price.

In the West, interest in gold bullion has gradually declined somewhat over decades, while demand from the East for storing wealth has been strong. I suspect the 2020’s decade, due to monetary and fiscal policy, could renew western interest in gold, but we’ll see. So, the argument that Bitcoin isn’t like gold because it can’t be used for anything other than money, doesn’t really hold up. Or more specifically, it’s about 10% true, referring to gold’s 10% industrial demand.

With 90% of gold’s demand coming from jewelry and bullion usage, which are based on perception and sentiment and fashion (all for good reason, based on gold’s unique properties), gold would have similar problems to Bitcoin if there was ever a widespread loss of interest in it as a store of value and display of wealth.

Of course, gold’s advantage is that it has thousands of years of international history as money, in addition to its properties that make it suitable for money, so the risk of it losing that perception is low, making it historically an extremely reliable store of value with less upside and less downside risk, but not inherently all that different. The difference is mainly that Bitcoin is newer and with a smaller market capitalization, with more explosive upside and downside potential.

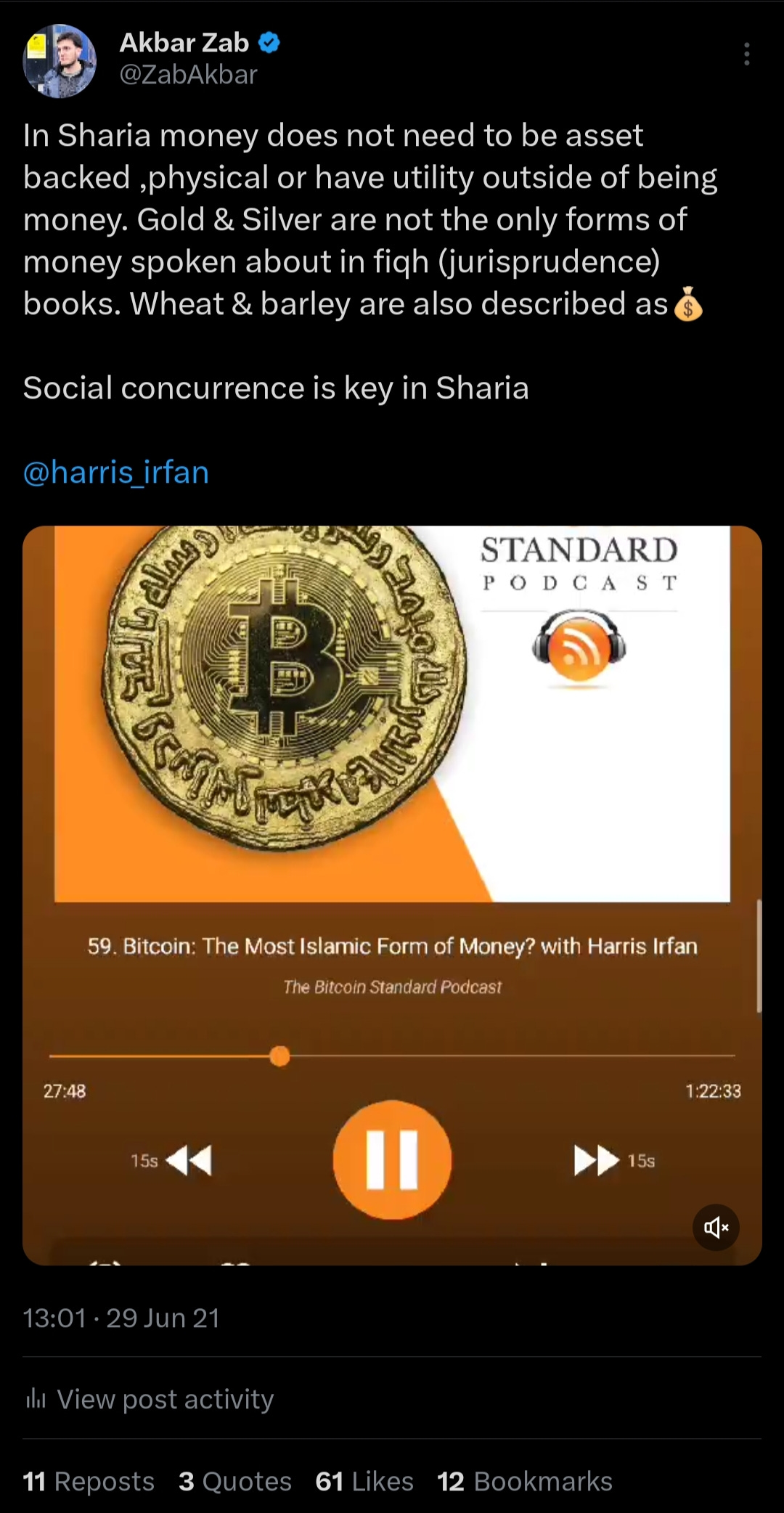

The second potential solution to the issue of riba fiat currencies is Bitcoin. Bitcoin advocates among Muslims propose that the Muslim Ummah should embrace a Bitcoin standard, arguing that Bitcoin's creation aimed to bypass and, ideally, supplant the debt-based fiat system of central banks. They acknowledge gold's historical role as the supreme form of currency in the analog world, but assert that in today's digital age, characterized by the internet, Bitcoin stands as the preferable solution rather than gold.

When Muslim Bitcoin enthusiasts hear Muslim gold enthusiasts proclaim that gold is the solution to the current riba-based fiat system because the Prophet Muhammad ﷺ used it, the Bitcoin proponents respond by stating that the Prophet ﷺ utilized gold due to its superiority as the monetary technology of his time. However, they emphasize that Sharia does not mandate gold as the exclusive legitimate form of currency.

"The idea that we are devotionally bound to using gold and silver is one that does not hold up with Islamic law. I know it's a very nostalgic view among some Muslims, but there is literally no evidence that we HAVE to use gold and silver. Those arguments are always utilitarian arguments about the independence of Muslim peoples and their ability to escape the global capitalist monetary system.

As far as religious evidence, there is nothing that says, "Oh you who believe, use gold and silver". Gold and silver were used at the time of the Prophet Muhammad ﷺ simply because they were the predominant currencies.

Interestingly enough, the very first dirhams and dinars, with dirhams being silver and dinars being gold... 'dinar' comes from the Roman Latin 'Dinarious', which is a coin of gold, and 'dirham' Greek comes from 'drakhmē'. Many times the coins that were used by Muslims will be Sassanid or Byzantine coins.

Even in 70 AH when Abdul Malik ibn Marwan had a mint built in Syria and struck their own coins and standardized the weights, you will find the Shahadah (declaration of faith in Islam, proclaiming that there is no god worthy of worship except Allah and that Muhammad ﷺ is His messenger) on one side and then on the other side a picture of the Sassanid or Byzantine king."

~ Shaykh Joe Bradford

Mufti Faraz Adam has also written an article presenting the case that Islamic jurisprudence does not mandate the use of gold, but rather that gold was used as money in the time of the Prophet Muhammad ﷺ due to its characteristics.

Is Gold the Currency of Islam?

The Dinar is typically referred to as the ‘currency of Islam’. The idea stems from the fact that the initial currency minted by an Islamic government was that of the gold Dinar and silver Dirham. It was the Caliph Abdul Malik ibn Marwan who ordered the minting of these currencies in the year 76 AH. However, does that mean that Islam has a specific currency it encourages or advocates? Far from it. Matters of economics and finance in Shariah are generally left to the people to do what is most optimal, fair, and useful for themselves within a divine framework featured in the Qur’an and Sunnah. Those elements which are relatively more likely to cause harm to individuals and society have been banned by Shariah. Such practices do not fall within the remit of human discretion in transactions.

In regard to an Islamic currency, Ibn Taymiyyah states that Shariah has not defined any specific condition nor definition for currency and has instead left it to the customary practice and governance of the people. Other scholars have enumerated various forms of money such as commodity money, customary money and more. This has always been the understanding and therefore during the Mamluk dynasty (872-922 A.H/1468-1517 CE), they introduced Fulus (copper coins) as a currency to use in small commercial transactions. The Ottomans introduced a currency named Qaimah in the form of paper money. In 1914, the Ottomans officially declared that paper currency was the only legal tender for the medium of exchange.

What makes gold so special then? It is the characteristics of gold that make it naturally appealing to humans to use as a currency. In earlier times, humans only had the elements in their natural environment. The most obvious thing to do was to use one such element which can represent the transfer of value. Something from their environment had to be used as a technology to represent value and facilitate exchange. Gold proved to have all the innate characteristics of a medium of exchange based on:

• Gold has no time limit or shelf-life; it is durable.

• Gold is portable

• Gold is divisible and malleable

• Gold is rare

• Gold is finite and has scarcityThere are 118 elements in the Periodic Table of Elements. Humans eliminated all of the elements that represent gas for obvious reasons such as the inability for it to be ascertained. Another 38 other elements could not be used in everyday exchanges as they posed a threat to human life and endangered the very people currency should serve. These elements were either too reactive, corrode over time and/or ignite when exposed to air. The medium of exchange had to be rare but not too rare to ensure it has maintained value and is not impacted by hyperinflation. That left only 5 possible precious metals: rhodium, palladium, silver, platinum, and gold. Platinum and palladium were proven to be too rare to create enough coins to circulate; people needed a metal that was somewhat rare so that not everyone produced their own coins, but available enough so a reasonable number of coins could be created to allow commerce. Silver wasn’t a good choice because it tarnishes over time and rhodium was also too rare to be used. This left gold as the strongest choice when making/choosing an element as a currency.

Thus, gold was not established as the currency because of it being gold, rather it was the characteristics and features of gold which made gold the dominant form of currency. A monetary system needs particular characteristics which create a conducive environment for monetary stability. Anything which harnesses these characteristics has the potential to serve as a currency; whether it is naturally found or digitally constructed. The purpose is to have a monetary language by which people can interact, exchange value, price items, and have economic stability, permitting the acquisition of everyday needs and a mechanism for remuneration.

- Mufti Faraz Adam

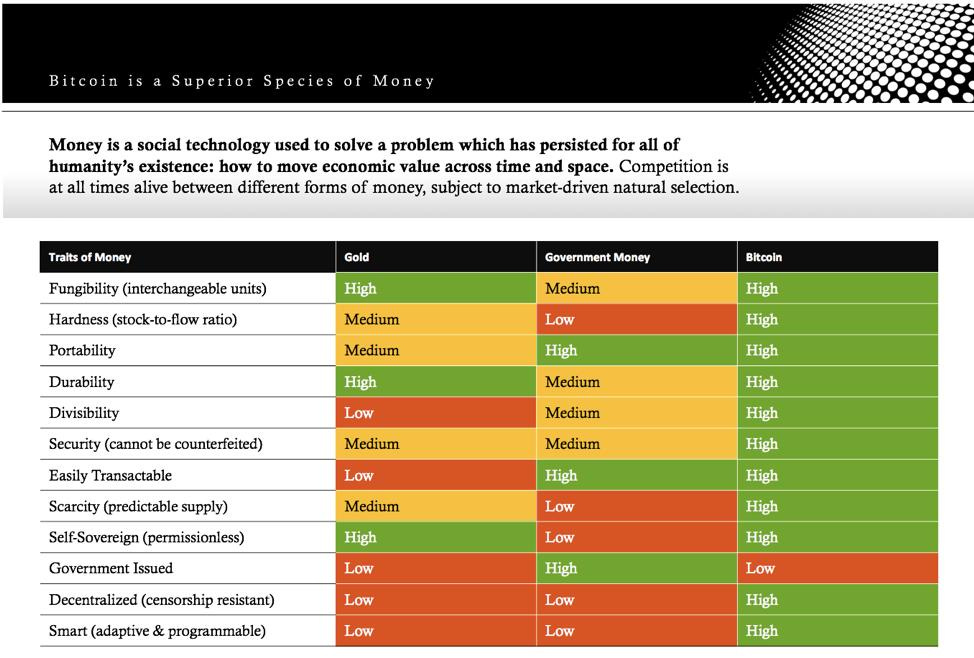

Bitcoin enthusiasts argue that Bitcoin possesses all the attributes of gold, such as divisibility, durability, recognizability, portability, and scarcity - attributes that make gold valuable. They also argue that Bitcoin enhances these characteristics even further and offers more, for example:

• Divisibility: Bitcoin is highly divisible, with each unit, known as a satoshi, representing a fraction of a Bitcoin.There are 100,000,000 satoshis in one Bitcoin. This divisibility allows for precision in transactions, making it practical for both large , small & micro payments. Gold, on the other hand, lacks this level of divisibility, as it is typically traded in larger units, such as ounces or grams.

• Durability: Gold is a physical metal, and while it doesn't corrode or tarnish much, it can be damaged. Bitcoin, being a digital asset, is not subject to physical wear and tear. It exists as data on a decentralized ledger, making it inherently more durable in the long term.

• Recognizability: Bitcoins are easily recognizable and verifiable through the decentralised blockchain. Gold can be authenticated through various methods, but it's an expensive and burdensome (melting gold) thing to do in contrast to the ease of verification that exists within the decentralised Bitcoin network.

• Portability: Bitcoin is exceptionally portable since it exists as digital information. You can carry significant wealth on a small hardware wallet or even memorize a seed phrase for recovery. Gold, on the other hand, is bulky and heavy, making it less practical for large-scale wealth storage and transportation.

• Scarcity: Bitcoin's scarcity is programmatically defined. There will only ever be 21 million Bitcoins in existence, making it highly predictable and resistant to inflation. In contrast, gold mining continues, and new deposits are discovered, which can impact its scarcity over time. Additionally, Bitcoin's scarcity is easily verifiable on the blockchain, while determining the exact amount of gold available can be challenging due to hidden reserves and ongoing mining activities.

Another contention that some Muslims, who advocate for a return to the gold standard, put forward against Bitcoin is that it's not physical/tangible. They make the argument that according to Islamic jurisprudence, money should be physical. Muslim bitcoiners respond by stating that money does not need to be physical for it to be considered Mal (mal (مال) refers to wealth or property. It encompasses all types of possessions that hold value and can be owned, such as money, goods, real estate, livestock, and other assets)

"Although some Hanafi jurists have stated that Māl must be a physical entity, Mufti Taqi Uthmani dispels this argument and states that the Quran and Sunnah have not explicitly defined Māl, rather, Shariah has left it to the understanding of people He thereafter quotes the Fatāwā of late Hanafi jurists which consider electricity and gas as Māl despite being intangible. Thus, intangibles can also be Māl on condition they are desirable and retrievable."

- Mufti Faraz Adam

Another important thing to note is that akin to gold, Bitcoin does not originate through interest-bearing loans, as fiat currencies do. Gold and Bitcoin are both mined, but their mining processes are quite different. Let's explore how they are mined and the proof of work and energy exerted in each case:

Gold Mining :

- Gold mining involves extracting physical gold from the Earth's crust. Miners use various methods, such as placer mining (panning for gold in riverbeds) or underground mining (digging tunnels to access gold veins).

- The proof of work in gold mining is the physical labor and machinery required to extract gold from the ground. This process can be energy-intensive, involving heavy equipment and transportation.

Bitcoin Mining :

- Bitcoin mining is a digital process where miners use powerful computers to solve complex mathematical puzzles. These puzzles secure the Bitcoin network by confirming and validating transactions in a decentralized manner.

- The proof of work in Bitcoin mining is the computational power and energy expended by miners to solve these puzzles. Miners compete to find a solution, and the first one to do so gets rewarded with newly created bitcoins. This process, called "proof of work," is intentionally resource-intensive to maintain network security.

In summary, both gold and Bitcoin mining are linked to a "proof of work" (POW) concept, it's energy expenditure. In contrast, fiat paper money creation by central banks is not tied to mining or proof of work; it's based on monetary policy decisions and riba debt creation & management.

Bitcoin enthusiasts recognize that it is prudent to have some gold as a store of value. Particularly if you are planning to only carry out face-to-face transactions within a small community level. However, it is not feasible to conduct long-distance transactions with gold. In fact, on this gold exhibits several weaknesses when compared to Bitcoin.

Weaknesses of gold include:

• Not easily divisible for small & micropayments.

• Portability is challenging, especially when transporting several kilograms overseas.

• It's not digital.

• Final settlement and physical delivery are notably slow and expensive, especially for large quantities.

• Verification, such as melting gold, is costly and burdensome.

• Secure storage comes at a high cost.

• Gold is susceptible to centralization.

• Governments have historically easily confiscated people's gold.

To address some of these limitations, currencies backed by gold were established. This enabled people to trade value more portably over long distances and engage in smaller transactions, albeit it also introduced new constraints, such as the reliance on Trusted Third Parties (Banks).

Gold-backed fiat currencies ceased to exist after President Nixon completely removed the gold backing of the US dollar in 1971. The dollar, which is the strongest among all fiat currencies and the one to which all other fiat currencies are tied due to America's military power, transitioned into a currency backed by debt. This transition made it easy to print and create currency at will.

We currently have multiple nation-state government paper fiat currencies, which are not backed by anything. Bitcoin enthusiasts argue that if the world were to return to the gold standard, the same situation would recur. In other words, a gold standard prompts governments to recognize the limitations of gold. Consequently, gold-backed fiat currency is introduced as a solution, leading to third-party trusted entities (banks) printing more money than they have in reserves due to the irresistible power and temptation to print money at will. Thus, we end up back where we started.

The parallels between the One Ring in the film "The Lord of the Rings" and the power of central banks, particularly the Federal Reserve, lie in their ability to exert control and influence over vast realms. Just as the One Ring promises dominance over Middle-earth, central banks wield significant power over economies through their control of monetary policy, including interest rates and the supply of fiat money. Like the One Ring's corrupting influence on anyone who puts it on, the unchecked power of usurious riba central banks lead to corruption and misuse. The temptation to keep issuing interest bearing loans results in inflation and economic instability for the average person, much like the corrupting influence of the Ring leads individuals to misuse its power for their own ends. Just as the Ring's malevolent will seeks to return to its evil master, the unchecked power of usurious central banks serves the interests of a select few at the expense of the rest of humanity. Exacerbating global wealth inequality and entrenching the influence of a parasitic financial elite.

Some Muslims have courageously attempted to reintroduce a gold standard. The leader of this movement was Shaykh Abdalqadir as-Sufi, born Ian Stewart Dallas on August 1, 1930. He was the Shaykh of the Darqawi-Shadhili-Qadiri Tariqa, the founder of the Murabitun World Movement, and the author of numerous books on Islam, Sufism, and political theory. He and his students, especially Shaykh Umar Vadillo, have fought against fiat currencies for decades.

Unfortunately, their noble and brave efforts kept encountering roadblocks, as stated by Shaykh Dr. Abdalqadir as-Sufi himself in an article.

"The defence mechanisms of today’s late capitalism and its crisis management surrounding the buying, moving and minting of gold have surrounded it with prohibitive pricing and taxation."

"It only works in a physical jurisdiction: Where to mint, where to store, how to transport, how to coordinate electronic payments, how to deal with banking regulations, taxes and government interference? Theoretically, it was possible to instantiate an entirely independent ecosystem of issuance, storage, transport and trade using gold, but real progress on it was very slow.

The only real Islamic alternative ever proposed was the Gold Dinar Movement. Starting in parallel (and in many respects earlier) than ‘‘Islamic’’ banking, (with the first modern Dinar minted in 1992), it was incisively accurate in its assessment and proposed remedy to the money problem:The Return to the Gold Dinar.

’’This was an earlier time, when the golden tool in the fight against fiat was literally gold, which was then popularized by Austrian economics, advocated by upright leaders like Ron Paul, and adopted by grassroots activists like Bernard von NotHaus. The Muslim world saw its own spate of activism for sound money, led by its most vocal proponent, Umar Vadillo, and associated initiatives like Wakala Nusantara, Dinar First and my own Dinar Wakala. The Kelantan State government’s launch of Gold Dinar was our own El Zonte moment, full of euphoria and promise that made waves globally. The passion and courage of this vibrant lot of Warrior Sufis represented the best of modern-day Muslims: Profoundly knowledgeable people, engaged in grassroots activism, to fix the most pressing challenges of the contemporary world.

However, the primary strength of gold, its physical indestructibility, came in the way of its adoption: Logistic and regulatory hindrances prevented free flow of physical gold coins across national boundaries. In the words of its founder, Shaykh Abdalqadir, “The defense mechanisms of today’s late capitalism and its crisis management surrounding the buying, moving and minting of gold have surrounded it with prohibitive pricing and taxation.” It continues to serve as a galvanizing symbol of the fight against Riba, but making it a practical inflationary hedge, or a broader Ummah-level movement for sound money, proved an elusive goal."

- Asim Shiraz

Shaykh Mu'awiyah Tucker has stated regarding those Muslims who still reminisce and advocate for a gold standard in the age of the internet:

"Every Muslim who calls for a return to the gold standard in the digital age is essentially advocating for a slowdown of international commerce and online businesses, which could potentially cripple Muslim nations."

A new, better solution is needed, and there is one. Bitcoin has overcome the flaws of gold without the need for trusted third parties, thanks to a decentralized, verifiable online ledger. As the famous Austrian economist put it, it's now a well-known quote in Bitcoin circles:

‘‘I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something they can't stop.’’

~ Friedrich Hayek in 1984

Friedrich Hayek's quote reminds me of something I heard Shaykh Hamza Yusuf say when discussing riba fiat currencies:

"The Sharia, the sacred law of Islam, does not recognize paper money unless it is backed by gold or silver. Muslims using paper money today (none of which is backed by gold or silver) will, insha'Allah, not incur punishment from God because humanity is forced by central banks to use them. However, Muslims are encouraged to try and find new alternative innovative ways to get around this tribulation of fiat currencies."

In particular, that last bit (‘‘Muslims are encouraged to try and find new alternative innovative ways to get around this tribulation of fiat currencies’’) truly brings Bitcoin to mind as the premier solution for Muslims who want to begin distancing themselves from the current riba-based fiat monetary system.

"I still believe that, so long as the management of money is in the hands of government, the gold standard with all its imperfections is the only tolerably safe system. But we certainly can do better than that, though not through government."

- Friedrich Hayek

What about Gold-Backed Crypto?

Some people argue once they've realized how corrupt and damaging the current global monetary system is and wish to merge the concept of digital payments and gold or cryptocurrencies with gold, for a hybrid gold-backed digital crypto project. The problem is it has been tried numerous times before and failed. You can't build a new financial system around gold simply because governments won't let you. BitGold was a company founded in 2014 by Joshua Crumb and Roy Sebag. In 2015, it rebranded to GoldMoney, offering services focused on precious metals. It operates as a platform that allows users to buy, sell, and store physical gold securely.

Here's how it works:

Account Creation: Users create an account on the platform, providing necessary personal information for identity verification purposes.

Buying Gold: Once the account is set up and verified, users can purchase gold through the platform using various payment methods, such as bank transfers or credit/debit cards.

Gold Storage: After purchasing gold, GoldMoney stores the physical gold in secure vaults on behalf of users. Users choose the location of the vault where their gold would be stored, providing options in various countries.

Account Management: Users manage their gold holdings through the platform, monitoring their investments, and making transactions as needed.

Redemption and Withdrawal: Users can sell their gold holdings back to GoldMoney or redeem their gold for physical delivery. This allows users to convert their gold holdings into fiat currency or take possession of the physical gold if desired.

There are several reasons why such a model cannot grow to become a new global financial system that helps humanity escape the current global central banks' fiat system. These reasons mostly boil down to the regulatory environment, the requirement for transactions to incur capital gains taxes, and the inability to obtain the banking clearances necessary for merchants to send and receive gold. Professor Saifedean Ammous elaborates on this in the short clip below. He himself tried to create something like this from 2011 to 2014 until he realized that the regulatory roadblocks were too many, and thus the idea could not scale:

Another company that previously offered digital payments of gold was e-gold, which was operated by Gold & Silver Reserve Inc. It was founded in 1996 by Dr. Douglas Jackson and Barry K. Downey. The number of e-gold accounts, as claimed by e-gold, grew from 1 million in November 2003 to 3 million on April 22, 2006. In 2008, the company reported having more than 5 million accounts.

E-gold operated as a digital currency backed by physical gold. Users could open an account on the e-gold website and deposit funds, which would be converted into grams of gold. These grams of gold were then stored in the company's vaults. Users could subsequently transfer these grams of gold to other e-gold account holders as a form of payment or exchange. Transactions were recorded in a public ledger accessible to all users.

E-gold was unique at the time in that it created the "e-gold Special Purpose Trust," which held title to the physical bullion on behalf of the users. It also created a real-time statistical reports page that showed the total holdings of each metal in the trust account, a list of gold bars with serial numbers, the total number of accounts, as well as the total number and value of transactions in the previous 24 hours. This transparency enabled many observations to be made about how e-gold was being used. Additionally, users had the option to redeem their e-gold balance for physical gold or fiat currency.

The United States Treasury issued a report on January 11, 2006, titled ‘‘U.S. Money Laundering Threat Assessment,’’ which Gold & Silver Reserve Inc (G&SR) believed was evidence favorable to its legal case, as explained in its January 20, 2006, letter. This apparently confirmed that e-gold accounts were excluded from the definition of "currency" under the United States Congress and Code of Federal Regulations definitions.

‘‘Starting in mid-December 2005, Gold & Silver Reserve, Inc. (G&SR), contractual Operator and primary dealer for e-gold, has been the subject of a warranted search of its premises and records, had its domestic bank accounts frozen, and been the target of a precisely timed, extraordinarily misleading attack by a major business publication.

In an emergency hearing in US District Court January 13, 2006, the freeze order on G&SR's bank accounts was lifted. Though numerous criminal claims had been made in obtaining the search and seizure warrants, the Government has not sustained these allegations and the only remaining claim is a contention that G&SR has operated as a currency exchange without the proper license. G&SR had previously proposed to the Government that e-gold be classified for regulatory purposes as a currency, enabling G&SR to register as a currency exchange. In a Treasury report released January 11, 2006, however, the Department of Treasury reaffirmed their interpretation of the USC and CFR definitions of currency as excluding e-gold.

G&SR, for nearly a year, has been engaged with an agency of Treasury in a BSA (Bank Secrecy Act) compliance examination it had voluntarily initiated. G&SR, though preferring that the venue was not a courtroom, welcomes the opportunity to extend its discussions with the Government on how best to achieve appropriate statutory or regulatory cognizance of e-gold while continuing to build e-gold's market share as a medium of international commerce.

Despite the unfounded charges and adverse misleading publicity that have severely damaged both e-gold and G&SR, G&SR has continued to meet all financial obligations and remain completely operational. e-gold remains highly committed to its goal of bringing, for the first time in history, to people of any financial means across the globe, a secure payment mechanism at a fraction of the cost of any other system. e-gold fully expects to transcend the unfortunate events of the past month and resume its exponential growth.’’

In 2007, the US Federal government accused e-gold of money laundering and other crimes, leading to the closure of several exchanges. Despite e-gold beginning to cooperate with prosecutors to monitor transactions, it was subsequently indicted and forced to block all accounts and transfers.

As you can observe, as e-gold gained popularity, regulatory scrutiny increased. Governments around the world began to impose stricter regulations on digital currencies, particularly concerning anti-money laundering (AML) and know-your-customer (KYC) requirements. E-gold struggled to comply with these regulations, leading to legal battles and ultimately its shutdown.

‘‘The USA Patriot Act, passed in the wake of the September 11 attacks more than five years after e-gold had been launched, made it a federal crime to operate a money transmitter business without a state money transmitter license in any state that required such a license. At the time a money transmitter was in most states defined as a business that cashed checks or accepted cash remittances to send from one person to another person across international borders, such as Western Union or MoneyGram. For example, prior to 2010, California regulated money transmitters under the “Transmission of Money Abroad Law”. One of e-gold’s competitors, the e-Bullion company, applied for a money transmitter license from the State of California in 2002, but was informed by the State of California that their business which dealt in gold accounts did not fall under the state’s definition of a money transmitter.

In 2005, G&SR requested that the IRS SB/SE Division conduct a BSA (Bank Secrecy Act) Compliance examination in order to clarify what regulations, if any, e-gold fell under. The United States Treasury issued a report on January 11, 2006 titled U.S. Money Laundering Threat Assessment which G&SR believed was evidence favorable to its legal case as explained in its January 20, 2006 Letter, apparently confirming that e-gold accounts were excluded from the definition of “currency” under the United States Congress and Code of Federal Regulations definitions.

However, in its actions from 2006-2008, the U.S. Treasury Department in conjunction with the United States Department of Justice stretched the definition of money transmitter in the USA Patriot Act to include any system that allows transfer of any kind of value from one person to another, not merely national currency or cash. Using this new interpretation they then proceeded to prosecute the USA-based gold systems, e-gold (and later e-Bullion) under the USA Patriot Act for not having money transmitter licenses, even though these companies had previously been cooperating with regulatory authorities and told they did not fall under the definition of money transmitter. The charge of not having a money transmitter license was eventually dropped against e-bullion. Several years later FINCEN further expanded this definition to apply to foreign companies allowing US persons to open accounts, which forced the Jersey based Goldmoney.com to suspend the ability to transfer value from one holder to another in December 2011.

A November 2013 article in Financial Times noted that “For several years, Mr Jackson had hoped to resurrect e-gold himself, but it became clear he would not be able to obtain the money transmitter licenses required in most US states.”

E-gold's centralized system was also susceptible to hacking and fraud. Despite efforts to enhance security, instances of fraud and theft occurred, damaging trust in the platform. E-gold's store of value and large user base made it an early target of financial malware and phishing scams by increasingly organized criminal syndicates. The first known phishing attack against a financial institution was made against members of the e-gold mailing list in June 2001. The technique was refined with attacks against digital gold systems like e-gold and later used to attack other financial institutions starting in 2003.

Therefore, overall, a combination of legal, regulatory, security, and reputational challenges contributed to the failure of e-gold as a digital currency platform.

Another major reason why a gold-backed digital or cryptocurrency won't work is that it necessitates reintroducing the concept of a third trusted party to hold and centralize the gold. This poses the very problem we are trying to avoid, given that historically, trusting third parties (such as banks, states, and companies) not to inflate the money supply has proven disastrous.

As you can tell, I'm keen on Bitcoin as a means through which humanity, particularly the Muslim Ummah, could turn to escape the current Zionist riba central banking system. However, I'm not the only one. There exists a small number of Muslims who advocate for the same ideas presented in this blog post. For example, Bitcoin Majlis is a non-profit organization established by two brothers who aim to encourage Muslims to start considering Bitcoin as a long-term solution.

Something else that is important to emphasize is that I advocate for Bitcoin ONLY. I do not like other cryptocurrencies that have emerged after Bitcoin. Why? Because I view Bitcoin as the only decentralized cryptocurrency that stands a chance at fighting back and inshallah winning, in the long run, against the global central banks' fiat system.

When Julian Assange exposed US war crimes by publicly releasing video evidence of US soldiers killing civilians in Iraq, the US government retaliated by pressuring several payment processors like PayPal and banks to freeze WikiLeaks' accounts. WikiLeaks couldn't access their funds, and as a result, supporters of Assange's courageous journalism couldn't send him funds.

However, Assange found a workaround by opting for Bitcoin instead, even though it was still in its infancy. Even at that time, the US government couldn't do anything to stop it. This incident, along with the fact that China has attempted to ban Bitcoin several times without success, demonstrates to me that the Bitcoin network is truly decentralized and resistant to censorship. I cannot make the same claim for other cryptocurrencies.

Other cryptocurrencies are either misguided projects whose use cases could be executed in a centralized fashion, or they are outright scams created to enrich founders by dumping on retail investors who have not conducted their research and are indiscriminately throwing money at any cryptocurrency, hoping for quick profit.

Now, although I do advocate for Bitcoin as the strongest potential solution humanity has to escape the current monetary system, I also acknowledge that I might be wrong. Maybe Bitcoin isn't the solution; perhaps the same people who set up the current central banking system we all use today also created Bitcoin for self-serving nefarious reasons. I've personally not come across any convincing arguments to substantiate this, but I’m not sure.

Why would those who benefit from the current monetary system, wherein they make decisions behind closed doors and create money at will in a centralized manner and exploit people and nations through debt and inflation, choose to create a decentralized network resembling gold? One that can be audited by ordinary individuals and whose money supply cannot be inflated? I do not know.

For example, when central banks convene meetings to discuss the increase or decrease of interest rates, which determine the levels of borrowing of fiat riba money by businesses and the public, the discussions held are not transparent to the public. The Federal Reserve in the United States, the main central bank atop this pyramid of riba, holds meetings with the Federal Open Market Committee (FOMC), but the details of what transpires are typically not immediately disclosed.